Line 2b - Dividends from Self-Employment. Today we will review the following.

Fannie Mae Income Calculation Worksheet Fill Online Printable Fillable Blank Pdffiller

However the income cannot be counted if the borrower is using the interest-bearing or dividend-producing asset as the source of the down payment or closing.

. Income earned from a foreign corporation or foreign government and paid in foreign currency. IRS Form 1040 Individual Income Tax Return. If interest or dividend income verify the payer is the same entity as the borrowers business review Schedule B Part I or II andor Schedule K -1 or Form 1099.

The total qualifying income that results may not exceed the borrowers regular employment income. Total qualifying income supplemental income plus the temporary leave income. You can find more details by going to one of the sections under.

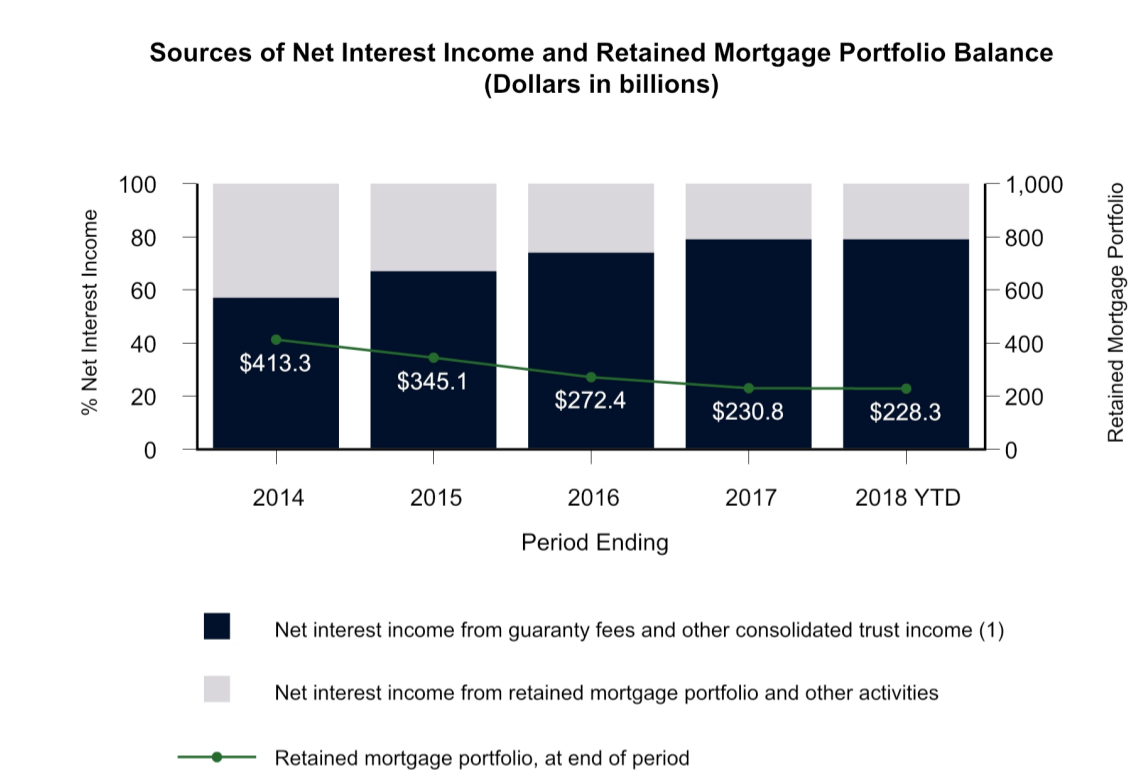

FNMA Operating Income as of today December 01 2021 is. About Dividend Yield TTM Fannie Maes dividend yield currently sits at 0 which is in-line with the Financial - Mortgage Related Services industrys yield of 000. Yes however lenders should apply additional due diligence to capital gains and interest and dividend income since it is calculated using a historical view.

Uses interest and dividend income to qualify. Uses tip income reported on IRS Form 4137 that was not reported by the employer on the W-2 to qualify. FNMAs dividend yield history payout ratio proprietary DARS rating much more.

Step 3 Enter dividendinterest income that cannot be used in qualifying ie. The analyst consensus target price for shares in Federal National Mortgage Association is 067. After the income available to the borrower for qualifying purposes has been determined the lender should.

This installment of the Underwriting guy video blog is Interest Dividends Capital Gains. Income from self-employment defined as a 25 or more ownership in the business. An IRS 1099 form.

Interest and Dividend Income. W-2 Income from Self-Employment Only add back the eligible Other deductions such as Amortization or Casualty Loss. A copy of signed federal income tax return an IRS W-2 form or.

Dividends from Self-Employment Line 5 3. IRS Form 1040 W-2 Income Officer Compensation Section 53041d1 Subtotal of W-2 income from self-employment 1Validate with business returns and IRS Form 1125-E Compensation of Officers as applicable 2. Schedule C Profit or Loss from.

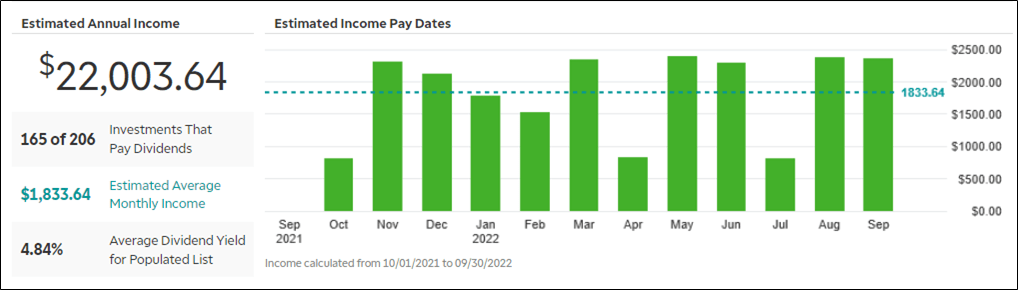

The 1 Source For Dividend Investing. The statement must specify the income type amount and frequency of the payment and. Total verified liquid assets.

70 rows Fannie Mae FNMA Dividend History. What the guidelines from FNMA on using interest dividendcapital gains. Review Schedule B Part I andor IRS Schedule K-1 or Form 1099-Int to confirm the payer is the same entity as the borrowers business.

Income from interest and dividends. Asset that will be used for closing Step 4 Total qualifying income Subtraction of subtotal in steps 1 and 2 from subtotal in step 3 Step 5 Enter the number of months that year to date or year 1 and year 2 dividends and interest income cover. What documents are needed to support these income types.

Ownership in the business. Analysts covering Federal National Mortgage Association currently have a consensus Earnings Per Share EPS forecast of. Interest Income from Self-Employment Line 1 b.

Review Schedule B Part II andor IRS Schedule K-1. Funds needed to complete the transaction. That is 3003 below the last closing price of 096.

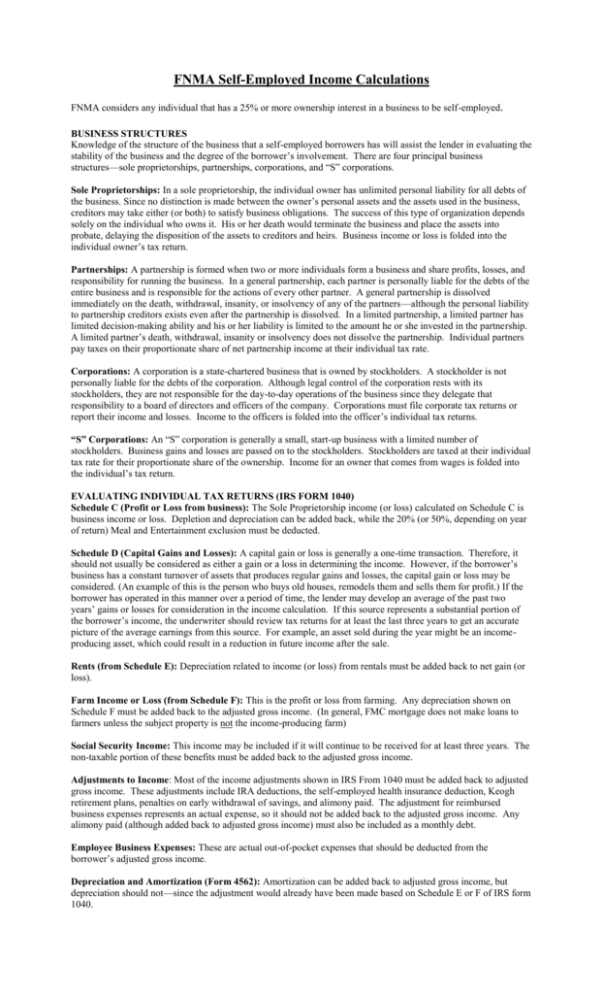

Schedule B Interest and Ordinary Dividends a. FNMA guidelines on interest and dividend income. Or receives income from sole proprietorships limited liability companies partnerships or corporations or any other type of business structure in which the borrower has a 25 or greater ownership interest.

Schedule B Interest and Ordinary Dividends Recurring interest income Chapter 5305. Get information about Fannie Mae dividends and ex-dividend dates. Income earned that cannot otherwise be verified by an independent and knowledgeable source.

The taxable interest and dividend income that is reported on IRS Form 1040 Schedule B may be counted as stable income only if it has been received for the past two years. Do not include business capital gains if. If income from a government annuity or pension account will begin on or before the first payment date document the income with a benefit statement from the organization providing the income.

In depth view into Fannie Mae Operating Income explanation calculation historical data and more. Learn more about Fannie Maes FNMA dividend history ex-dividend date and yield. While two years of tax returns are still required to demonstrate a stable history of capital gains and interest and dividends in come lenders must consider the current value of the.

FNMA - If Business capital gain evaluate the consistency or likelihood of continuance of any g ains reported on Schedule D from a business through the K-1 Form 1065 1120-S. Identify dividend income paid to the borrower from the borrowers business. Fannie Mae is the largest non.

Identify interest income paid to the borrower from the borrowers business. The lender should then subtract any dividend income from the business that the borrower reported on his or her individual tax return to arrive at the total income available to the borrower for qualifying purposes.

Divdend Interest Income For Mortgage Qualification Youtube

Fnma Self Employed Income Calculations

Du Job Aid Entering The Data For A Release Of Liability

Young Professional Investor On Instagram Have You Invested In Dividend Producing Shares Yet If So Dividend Income Money Management Advice Investing Money

Fannie Mae Reports Comprehensive Income Of 3 9 Billion Housingwire

8 Monthly Dividend Stocks To Buy For Consistent Income

2 Gunstige Dividendenaktien Die Jetzt Ein Kauf Sind The Motley Fool Deutschland

Du Job Aid Entering The Data For A Refinance Loan

Green S Portfolio September 2021 Seeking Alpha

2 Stocks That Cut You A Check Each Month The Motley Fool

Interest And Dividends Tax Return

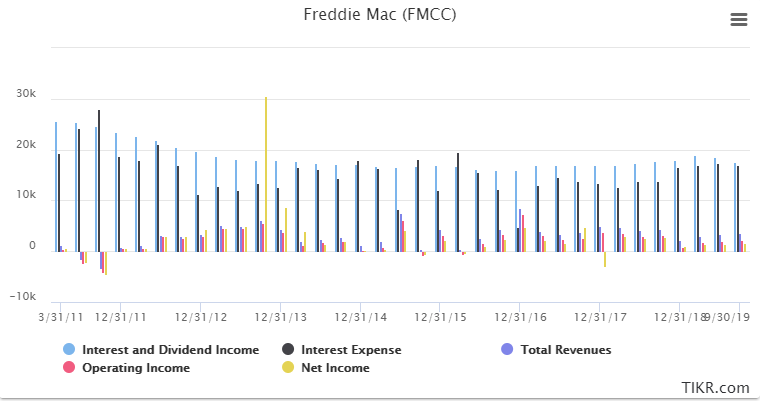

Freddie Mac Significantly Undervalued When Strong U S Mortgage Market Is Considered Otcmkts Fmcc Seeking Alpha

Interest And Dividends Tax Return

Mortgage News Digest I Need Income Computation Training Means I Don T Understand Self Employment

Hoya Capital Launches High Dividend Yield Etf Riet Nasdaq

Top 12 Reliable Stocks That Pay Monthly Dividends Dividend Income Dividend Dividend Stocks

Top 12 Reliable Stocks That Pay Monthly Dividends Dividend Income Dividend Dividend Stocks

0 komentar:

Posting Komentar